A closer look at your Supreme foundation.

OPERATIONS, PRODUCTS & TECHNOLOGY.

PRODUCTS & PROGRAMS

LOAN PROGRAMS

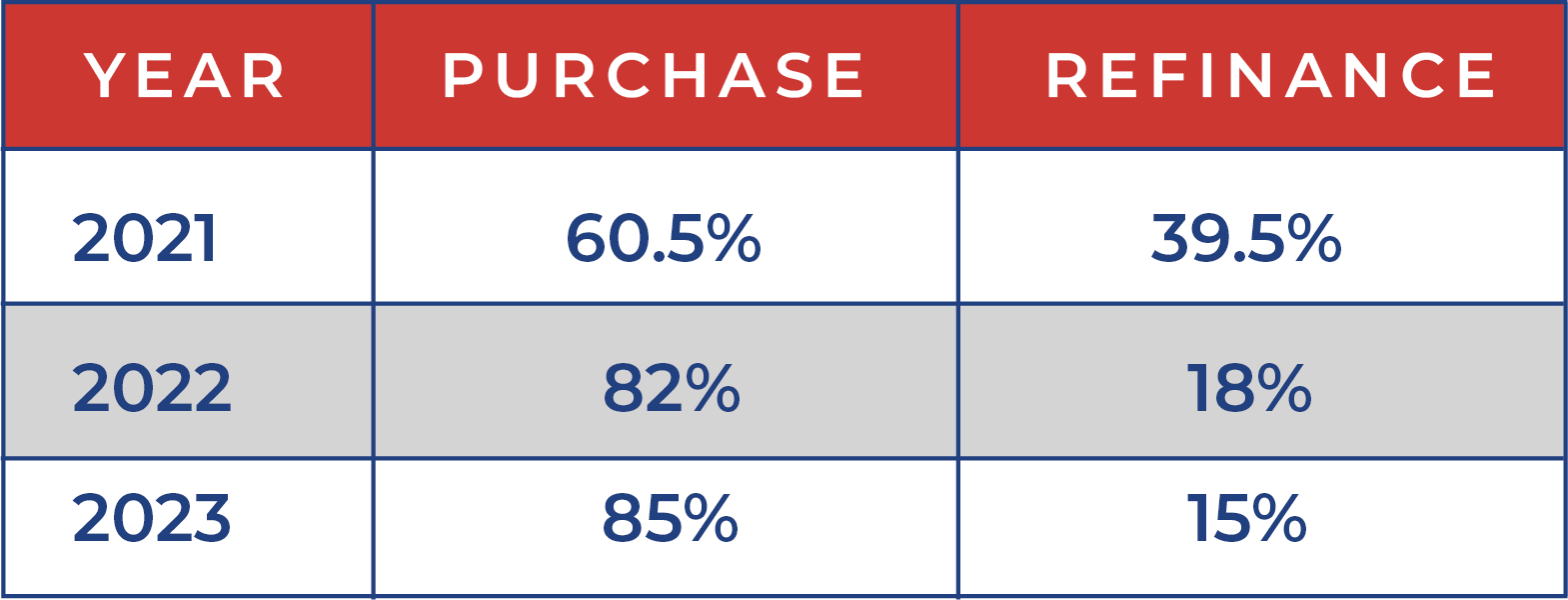

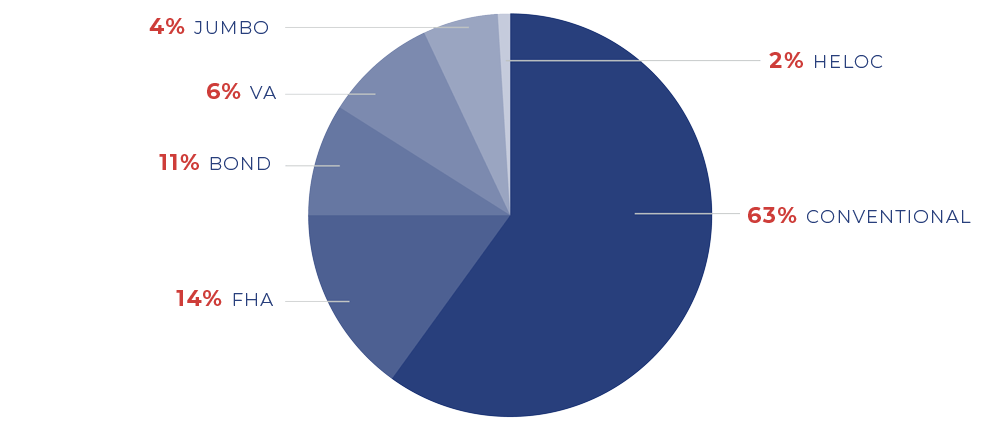

PRODUCT MIX

Supreme is focused on purchased business, which brings greater stability and predictability.

Supreme Lending is a Fannie, Freddie, and Ginnie Seller/Servicer. We also offer several non-conforming and specialty products to help meet just about any lending need.

SUPREME LOAN PROGRAMS

Now, more than ever, your customers and referral partners need options.

- Proprietary Down Payment Assistance Programs

- Licensed in all 50 states to offer local First-Time Home Buyer programs

- Work with multiple investors for better pricing

- Multiple property financing (7-10 properties)

- Renovation Loans done in-house

- Construction Loan one time close up to conforming limits

- Interest-only ARMs (available on non-conforming products since FNMA/Freddie don’t allow I/O)

- Follow AUS with no overlays

- Options for NO MI and NO LLPA’s (Loan Level Price Adjustments) for First-Time Homebuyers

- Proprietary Down Payment Assistance Program starting with 620 FICO score

- FICO score minimum as low as 580

- FHA 203(k) Renovation done in house

- Solar and wind technology additions

- Manual underwrite allowed

- Construction to Perm / One Time Close up to FHA county limits

- Follow AUS no overlays

- Down Payment Assistance available in all 50 states

- ITIN Borrowers

- Up to 100% LTV with 580 FICO score

- VA IRRRL with no appraisal with 580 FICO score

- VA High Balance

- VA Renovation

- Manual underwrite allowed

- Construction to Perm / One Time Close up to VA county limits

- Up to 89.99% LTV/CLTV to $2 million with 680 FICO score

- Up to 80% LTV/CLTV to $2 million with 660 FICO score

- Up to 80% LTV/CLTV to $3 million with 680 FICO score

- Jumbo option with no reserve requirements

- Interest-only ARMs

- In-house underwriting delegation

- Asset depletion available

- Projected income

- Non-warrantable condos

- 40-year loan term

- DTI up to 49.99%

- Unlimited Cash-Out options

- Use of DU/LP Findings

- In house Bank Statement and DSCR Programs

- No Doc / Lite Doc Programs

- Non warrantable condos

- Ability to exclude departing residence

- In-house Reverse Mortgage

- Bridge financing available – Buy before you sell

- In-house Home Equity Lines / Loans

- Temporary Interest Rate Buydowns

- 1099- and 12-month P&L income qualifications

- Up to 100% LTV with 600 FICO score

- USDA Streamline refinance

- Manual underwrite allowed

- ARMs available

TECHNOLOGY

Say hello to your new tech tool box.

Integrated technology that improves efficiencies, generates more leads AND enhances our customer experience.

OPERATIONS TEAM

“Speed is everything. It is the indispensable ingredient to competitiveness.” – Jack Welch

SERVICE & SUPPORT

Origination And Operations

Our top priority is making it easy for you to do business, and most importantly, succeed in your business.

Support Team

- Deal Desk Team available to calculate income and run loan scenarios 7am to 7pm

- Dedicated Processor and Loan Officer Assistant

- Dedicated Underwriters and Closers for the Simply Supreme region

- Onboarding and training team to support you during transition

- Project review office to assist with condominium approvals

Lending Library

- Easy access to all Supreme guidelines and product information

- Policies and procedures

- Loan matrices, job aids, and worksheets

- Reference guides

- Broker resources

Program Finder

- Quick search for the best products

- Transparent pricing quotes

- Simple side-by-side loan comparison

Expert In-House Processing, Underwriting, Closing, and Funding Teams

- Dedicated teams to review and process Condo, Jumbo, and Renovation loans

- Express funding through trusted partnerships with title companies

- 2-hour average Trust and Power of Attorney (POA) review

- Ability to communicate with underwriters and immediate responses to escalations

Supreme Lending is an equal opportunity employer and does not practice discrimination based on age, gender, race, religion, national origin, as well as any other rights afforded to applicants under state and federal law. For industry professionals only. Distribution to the general public is prohibited. Notices. Everett Financial, Inc. dba Supreme Lending, NMLS ID #2129 (www.nmlsconsumeraccess.org} 14801 Quorum Drive, Suite 300, Dallas, TX 75254 (877.350.5225) Copyright © 2024 Everett Financial, Inc. dba Supreme Lending. All rights reserved. Equal Housing Opportunity Lender.